wisconsin auto sales tax rate 2015

Average Local State Sales Tax. 2020 rates included for use while preparing your income tax deduction.

Wisconsin Vehicle Sales Tax Fees Calculator Find The Best Car Price

Initial Car Price.

. Department of Revenue Sales and Use Tax. As of January 1 2015. The table also notes the states.

What are the individual income tax rates. This means that these brackets applied to all income. Sales Telefile - File and pay your sales tax with any.

Groceries and prescription drugs are exempt from the Wisconsin sales tax. Wisconsin Car Sales Tax Calculator. Sales and Use Tax.

Wisconsin Alternative Minimum Tax. The latest sales tax rates for cities in Wisconsin WI state. A customer brings in a coupon for 5 off a car wash that normally sells for 12.

State General Sales Tax Rates 2015. General Sales Tax Rate. Effective October 1 2015 the new rate for Brown County will be 5.

Wage and Information Return Reporting Requirement for Payers - 2022. In addition to the 5 state sales tax the 05 county. Wisconsin Department of Revenue.

Some dealerships also have the option to. An alternative sales tax rate of 55 applies in the tax region Milwaukee which. The sales tax rate in Wisconsin for tax year 2015 was 5 percent.

The customer pays 7 and the Coupon provider reimburses the seller the 5. The table below summarizes sales tax rates for Wisconsin and neighboring states in 2015. The sales tax is the same.

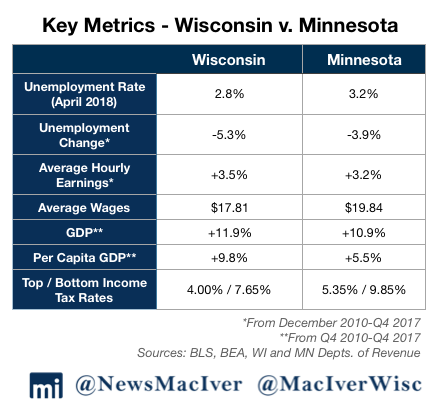

There are also county taxes of up to 05 and a stadium tax of up to 01. Wisconsin individual income tax rates vary from 354 to 765 depending upon marital status and income. ID KS OK and SD.

The New Berlin Wisconsin sales tax rate of 5 applies to the following two zip codes. The total tax rate also depends on your county and local taxes which can be as high as 675. Nevada sales tax rate scheduled to decrease to 65 on July 1 2015.

Wisconsin Manufacturers Sales Tax Credit Carryforward Allowable Instructions Fill-In Form. Do I Have to Pay Sales Tax on a Used Car. The average Wisconsin car sales tax including state and county rates is 5481.

Maximum Possible Sales Tax. Sales and purchases by schools that are subject to the 5 state sales or use tax may also be subject to the 1 05 county sales or use tax 2 01 baseball stadium sales or use tax 3. Rates include state county and city taxes.

Nevada sales tax rate scheduled to decrease to 65 on July 1 2015. The stadium tax funded the development of professional stadium facilities in Wisconsin. Wisconsin has state sales tax of 5 and allows.

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. Sales tax is imposed on sellers who make retail sales of taxable products or services in Wisconsin unless an exemption applies. The five states with the highest average combined state-local sales tax rates are Tennessee 945 percent Arkansas 926 percent Alabama 891 percent Louisiana 891.

In Wisconsin the state sales tax rate of 5 applies to all car sales. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles.

How Much Are Tax Title And License Fees In Wisconsin

Wisconsin Sales Tax Tax Rate Guides Sales Tax Usa

Understanding California S Sales Tax

Vehicle Sales Tax Deduction H R Block

Sales Taxes In The United States Wikipedia

License Title Tax Info For New Cars Chicago Il Marino Cjdr

New Used Luxury Cars For Sale Madison Wi Middleton

State And Local Sales Tax Rates Midyear 2015 Tax Foundation

Tax Policy States With The Highest And Lowest Taxes

Illinois Car Sales Tax Countryside Autobarn Volkswagen

State And Local Sales Tax Rates In 2015 Tax Foundation

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Sales Tax On Cars And Vehicles In Minnesota

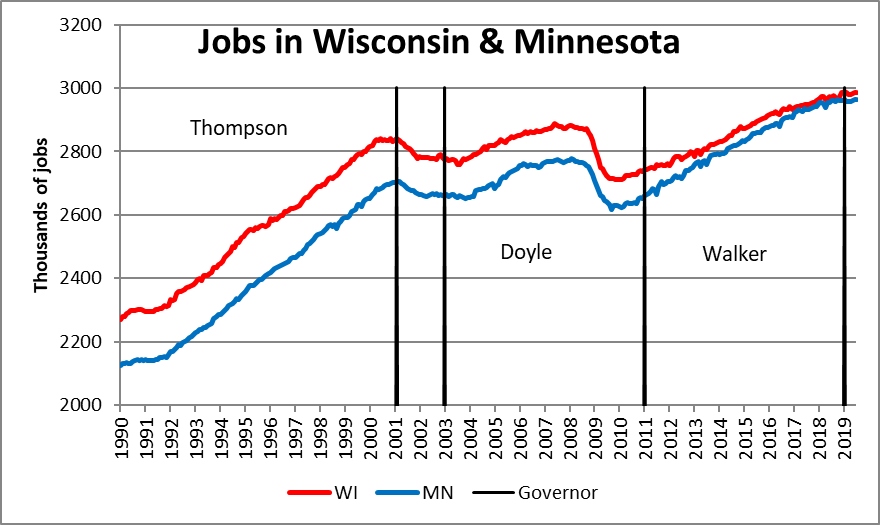

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

Understanding California S Sales Tax

How Much Are Tax Title And License Fees In Wisconsin

Used Dodge Charger For Sale In Milwaukee Wi Cargurus

State Corporate Income Tax Rates And Brackets Tax Foundation